2. Looking to “expensive” colleges can net larger award letters and lower overall cost.

Old Way

We run away from the “expensive” colleges with big price tags and go after the “cheaper” in-state public colleges.

Old Result

We’ve significantly reduced the available college options for our students. Ironically, given the lower graduation rates of in-state public colleges, we inadvertently pick the colleges that end up costing families the most due to delayed graduation.

New Way

We chase the “expensive” colleges because we recognize that they can potentially pay bigger scholarships . We use more of the college’s money to pay for college and less of our own. These “expensive” colleges, with better 4-year graduation rates further minimize cost by providing a lower cost of graduation. With the right data, our students have a wider range of colleges to choose from beyond the typical in-state public options.

New Result

Our students get into the best possible colleges at the lowest possible prices.

Many so called “expensive colleges” actually pay very large scholarships. Often times the cost of graduation is less than an in-state public university. Sometimes, the same is true with the total cost of attendance.

Private colleges typically have a higher sticker price, but they can also offer more financial aid."

Emma Kerr - US News and World Report: The Cost of Private vs. Public Colleges . June 25, 2019

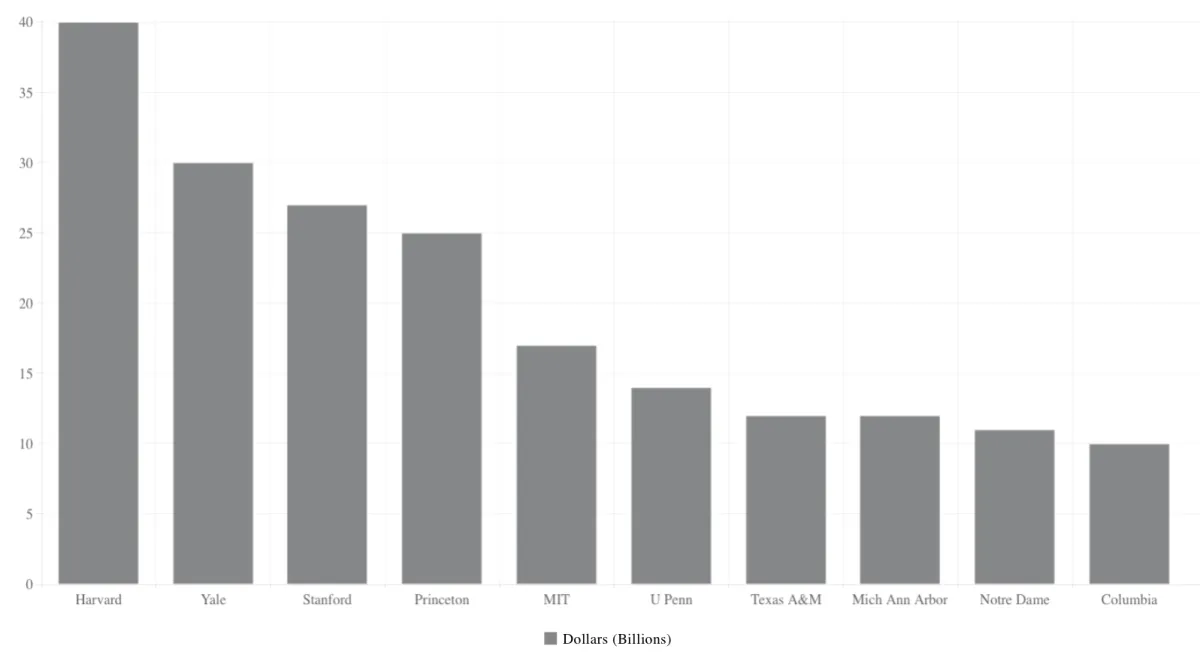

10 Universities With the Biggest Endowments

END OF FISCAL YEAR 2019 ENDOWMENT - 10 Universities With the Biggest Endowments, U.S. News data. By Ilana Kowarski | Sept. 22, 2020

As you can see above, these “non-profit” institutions are hoarding some serious cash. Again, many colleges not even mentioned on this list still have hundreds of millions stashed away.

Award Analysis - Sheridan Lillie Case Study

*2021 Award letter data provided by the Lillie Family. Cost includes tuition, room and board, books, mandatory fees and personal expenses.

As you can see, 4 out of 7 “expensive” colleges on Lillie’s list came under the in-state average cost of about $26,000 while offering better 4-year graduation rates.

FAQ

How is this true? Our guidance counselors have been telling us to go in-state for years.

Often times, many guidance counselors just don’t know. The in-state myth is a very persistent one that you will hear from your financial advisor, CPA and many financial gurus and advocates. We’re just stating the facts.

I know there are families paying full-price at these “expensive colleges.” Why are they paying full price?

There are a lot of variables here, but our guess is that they just don’t know what we know. A significant percentage of our clients already have college planners or financial advisors that they turn to for help. Often times, some families are told that they “make too much” and that they could not get any money, only to find that they can. They just expanded their understanding of how colleges really work.

Is there a catch here? The case study you presented probably has an amazing GPA and unrealistically high test score.

There’s no catch. Lillie had a 3.6 GPA and a 23 on the ACT when she obtained these results. Often times, the students with mid range GPAs and test scores can get amazing merit awards. It’s about knowing where to look and finding the right fit.

©2026 Game Theory College Planners, Inc. All rights reserved. Privacy Policy | Terms of use | We are a national service provider based in Atlanta, GA.