Our Process and Thesis

Here are 7 unique and useful insights that will completely change everything.

Written by Danny Umali, founder of Game Theory College Planners.

1. Understanding 4-year graduation rates will significantly reduce your college expense.

Old Way

We evaluate college cost by “cost of going.” We pay zero attention to 4-year graduation rates.

Old Result

We end up reducing the value of your student’s college degree by hundreds of thousands of dollars over their lifetime. With delayed graduation, the “cheaper” in-state college ends up being the most expensive college you could possibly buy.

New Way

We evaluate colleges by the “cost of graduating.” We adopt a college planning strategy that is 4-year graduation centric ; from how we evaluate majors to an analysis of academic fit, retention rate, and, of course, 4-year grad rate.

New Result

The national average of a 4-year graduation is 19%* . By employing an on-time graduation strategy, over 90% of our students graduate in 4 years and many get their degree at the lowest possible cost.

Source: Complete College America - Data Dashboard

2. Looking to “expensive” colleges can net larger award letters and lower overall cost.

Old Way

We run away from the “expensive” colleges with big price tags and go after the “cheaper” in-state public colleges.

Old Result

We’ve significantly reduced the available college options for our students. Ironically, given the lower graduation rates of in-state public colleges, we inadvertently pick the colleges that end up costing families the most due to delayed graduation.

New Way

We chase the “expensive” colleges because we recognize that they can potentially pay bigger scholarships . We use more of the college’s money to pay for college and less of our own. These “expensive” colleges, with better 4-year graduation rates further minimize cost by providing a lower cost of graduation. With the right data, our students have a wider range of colleges to choose from beyond the typical in-state public options.

New Result

Our students get into the best possible colleges at the lowest possible prices.

3. Using social media can increase your admissions chances and your merit awards.

Old Way

Many admissions counselors and college planners are unaware that social media can be used in a proactive way. When social media is mentioned, it’s usually as a warning comprised of two major viewpoints: 1. Don’t do anything stupid 2. Run away and hide. We do not see the value of social media and rely instead on the college essay and transcript and test score to tell our student’s story.

Old Result

We rely on magazines, online ranking lists, internet forums (a.k.a noise) for our “college research.” Family’s insights into the colleges are fragmented, conflicting, and limited. Our students get “lost in the stack,” with no options to set themselves apart other than tired essays, subjective grades, and arbitrary test scores.

New Way

We leverage social media as a tool rather than a toy . Using social media, our students and parents get “real time” and useful data that is arguably unattainable through other means, even through a college visit. Social media allows a student to tell their story on their terms. Our students develop lifelong skills that will serve them beyond college and into their careers. Our students are not limited to 500-700 words on an essay, a GPA, or a test score.

New Result

With better data, our families and students make smarter decisions. Our students tell their story with a broader canvas, increase their visibility to the colleges and receive greater merit scholarships.

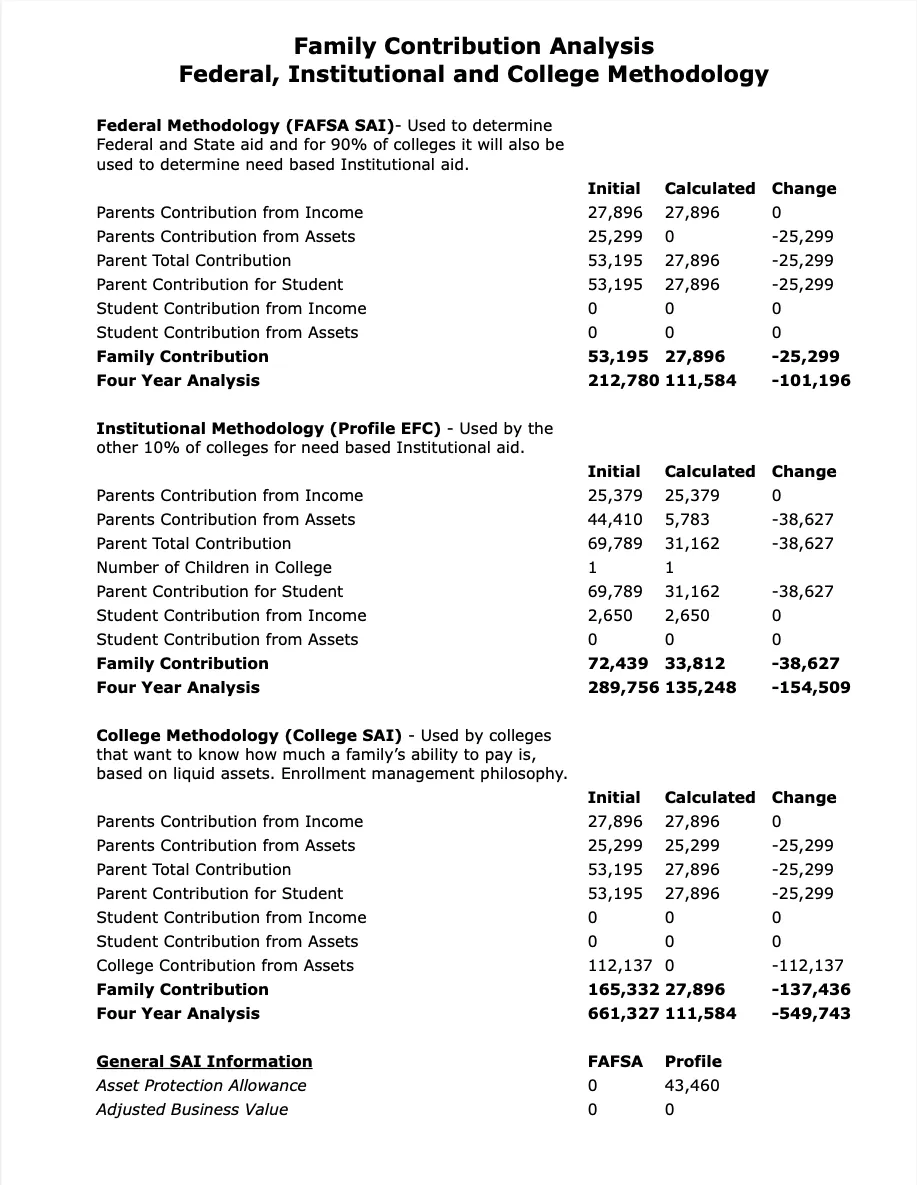

4. Knowing your Student Aid Index (SAI) before the government or college does will save you thousands of dollars.

Old Way

We are guided by an imperfect understanding of how financial aid really works. We overpay by tens of thousands of dollars.

Old Result

We drastically alter the kinds of colleges we think our students can attend and many dream schools are needlessly crossed off the list.

New Way

We calculate our SAI and how the colleges will apply that calculation beforehand and take necessary steps to maximize our financial aid. We recognize that colleges award merit aid based on financial aid leveraging. We drastically alter the kinds of colleges we think our students can attend with less limitations on cost. We increase our college options.

New Result

By knowing and leveraging your SAI in advance, we save tens of thousands of dollars while attending colleges we never thought were affordable.

5. Empirical data leads to smarter college decisions.

Old Way

We leave what is potentially a $200,000-300,000 decision in the hands of a teenager. We pick colleges based on factors that do not predict success.

Old Result

We end up with students unhappy from a break-up with their girlfriend or boyfriend. They realize that their other friends have changed. Students find themselves over or underwhelmed from their coursework. Students drop-out, transfer, or end up living at home on your couch. Parents find themselves with student debt they cannot afford.

New Way

We evaluate colleges with the latest metrics available and with the greatest predictors of success in addition to meeting the students social and personal expectations of the college experience. We strike a balance between finding the college your student wants and finding the college your student needs. For parents, we find colleges that are affordable.

New Result

We use empirical data as a foundation for college success. Students find themselves exactly where they should be and where they want to be. Parents find themselves able to pay for it.

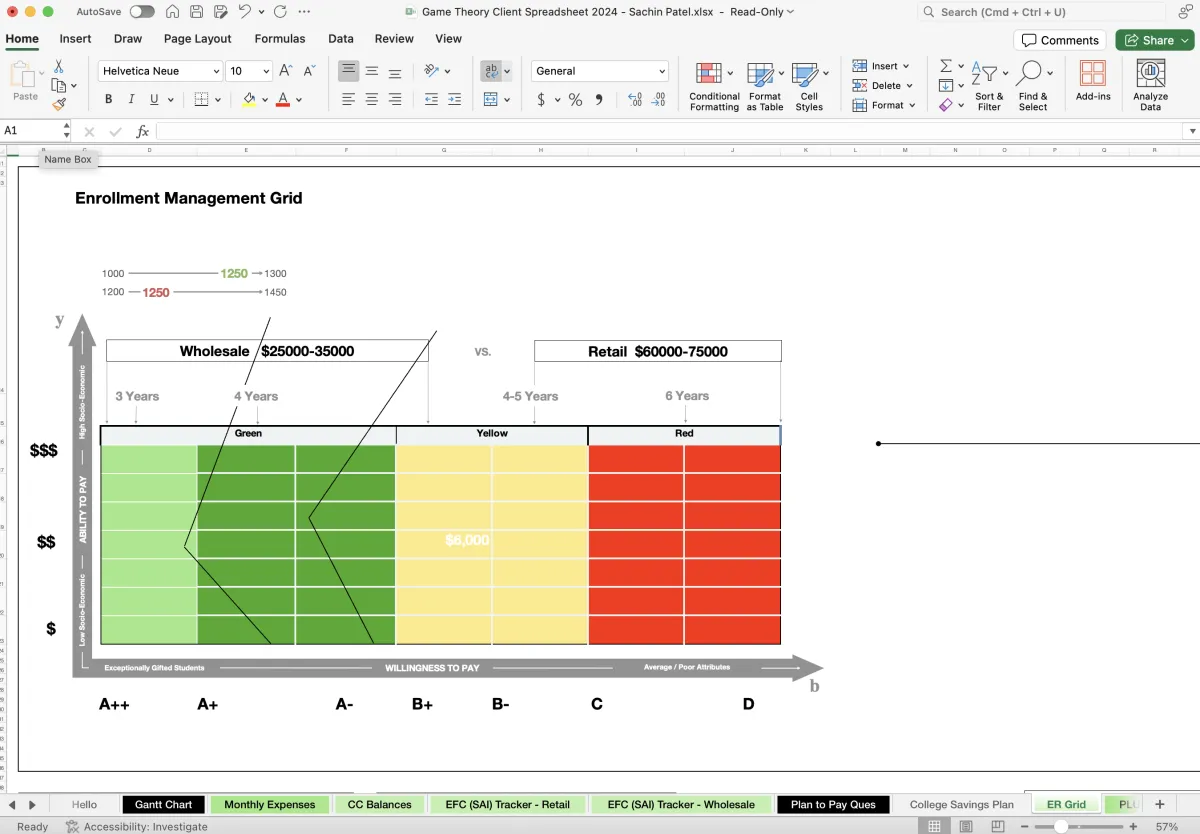

6. Creating competition between colleges maximizes your merit aid awards & grants.

Old Way

We enter the college marketplace ready to buy a college thinking the colleges set the price as the sellers. We are unaware of the price “elasticity” that exists with colleges.

Old Result

We end up overpaying for college since we do not truly understand the dynamic relationship of who the buyers and sellers really are.

New Way

We evaluate colleges by their enrollment yield. We use additional metrics to filter out colleges that are willing to buy your student vs. colleges that are not. We understand that the colleges are the buyers looking to buy my students with thousands of dollars in merit aid. We understand that competition drives the merit award process. We get our students into some of the best colleges in the country at a fraction of the price because we are not beholden to outdated thinking.

New Result

Through competition we have maximized our merit awards while gaining more options to attend a great college at a significantly lower cost.

7. Validating award letters for consistency drives college costs down to the absolute minimum.

Old Way

We accept the award letter at face value. Families sophisticated enough to file appeals or initiate professional judgement do so without the right data.

Old Result

We end up overpaying the college by thousands of dollars. Multiplied over 4 years, this can be a staggering amount.

New Way

We evaluate all financial aid appeal or professional judgement strategies. We go into the appeal with the data we need so we know how far we can go.

New Result

By validating award letters through financial aid appeal, we leave no money on the table. We get into colleges with the highest possible gift aid (need and/or merit aid) and at the lowest possible cost.

As you can see. All you need to do is…

1. Understand your 4-year graduation rates.

2. Look to the “expensive” colleges.

3. Use social media to increase your admissions chances and your merit awards.

4. Know your Expected Family Contribution (EFC) before the government or college does.

5. Use your head first (with empirical data), then your heart, to make smarter college decisions.

6. Create competition between colleges.

7. Validate award letters for consistency.

…and get your student into the best possible college at the lowest possible price by knowing which colleges will admit and how much they will award BEFORE you apply with hilarious predictability and ridiculous consistency at a cost equal or less than what other counselors charge.

We charge much less than what college planners and admissions counselors typically charge despite the fact that we do more, a lot more.

At a cost of about 1.5 months of college, you can get about two years of college for free.

In our industry, this is what we call a no-brainer.

Now there are a few ways to achieve this:

Option 1: The hard way

1. You can do it yourself. This can take up to 200 hours and cost you $40,000-$80,000 in lost aid potential.

There is no upfront cost and you can can simply “Google” your way through it or you can lose yourself in Reddit or other online message boards. The problem is not necessarily in finding the right answers, it’s about knowing which questions to ask. You might get close to achieving our result but you can spend up to 200 hours but a single misstep could still cost you tens of thousands of dollars.

2. You can work with your school counselor. You might get 1 hour with them, then you are on your own… so 200 hours + 1 hour with your counselor and $40,000-$80,000 in lost aid potential.

There is no upfront cost.

However, school counselors are overworked

with unrealistic case loads and are limited in their training with college admissions and enrollment management. They also do not know how financial aid really works. They simply cannot give you the expertise, time or energy required to achieve the same results.

3. You can work with your CPA or financial advisor. (How long does it take to get you into a 529 plan that will likely reduce your financial aid?) Then you are on your own…. we are at 200+ hours and $40,000-$80,000 in lost aid potential in addition to whatever financial aid the 529 will potentially offset.

Financial advisors and CPAs are fantastic professionals in their respective fields of investment advice and tax planning. However, they can come up short when tasked with college planning. These

financial professionals only have a limited understanding of the federal aid laws and how these laws are applied for federal aid.

Enrollment management, or how colleges really spend their own money is an area that is outside of their scope of knowledge. Often times, their techniques with financial and tax planning can actually have a negative effect on your financial aid which can result with you paying tens of thousands of dollars more for college rather than less. The cost of lost financial aid can be staggering. Many financial professionals even suggest that you student compromise their college picks, limiting the choices to in-state options and community colleges.

4. You can work with the typical admissions counselor, college planner or independent educational consultant (IEC). At their hourly rate, how many hours can you afford? Maybe 6-8 hours of some other outdated version of college planning?

We’ve seen other planners charge $6,000-$10,000, some even as high as $40,000 and they don’t even come close to our level of planning. These fees may be in addition to a ridiculous hourly rate.

Since 2010, the college planning niche has exploded in popularity and it seems like everyone “wants in” on this niche.

There are countless “college planners” and “admissions counselors” contributing to the noise.

There are also a lot of “pop up” college planning agencies that have seemingly come out of nowhere. The fact is that many independent educational consultants spend more time focused on getting your student admitted to a college with little to no assistance on how to find the money to pay.

Often, we’ve. come across services that are very limited and fragmented at best. Many approaches are ineffective and many planners do not even track or provide proof of their results. We’ve seen it all and we’re not impressed. Furthermore, the common methodologies of good grades, test scores, and essays prevalent in this field are based on outdated principles 20-30 years past their shelf life.

Option 2: The easy way

Or you can work with Game Theory College Planners and get your student into the best possible college at the lowest possible price by knowing which colleges will admit and how much they will award BEFORE you apply with hilarious predictability and ridiculous consistency. Our families save an average of $84,000 off a college education, basically getting 4 years of college for the price of 2, sometimes even less.

You can do all of this 10x faster than doing it alone and at a fraction of the price than what other planners charge.

Again, thousands of families have used us to achieve fantastic results for over two decades.

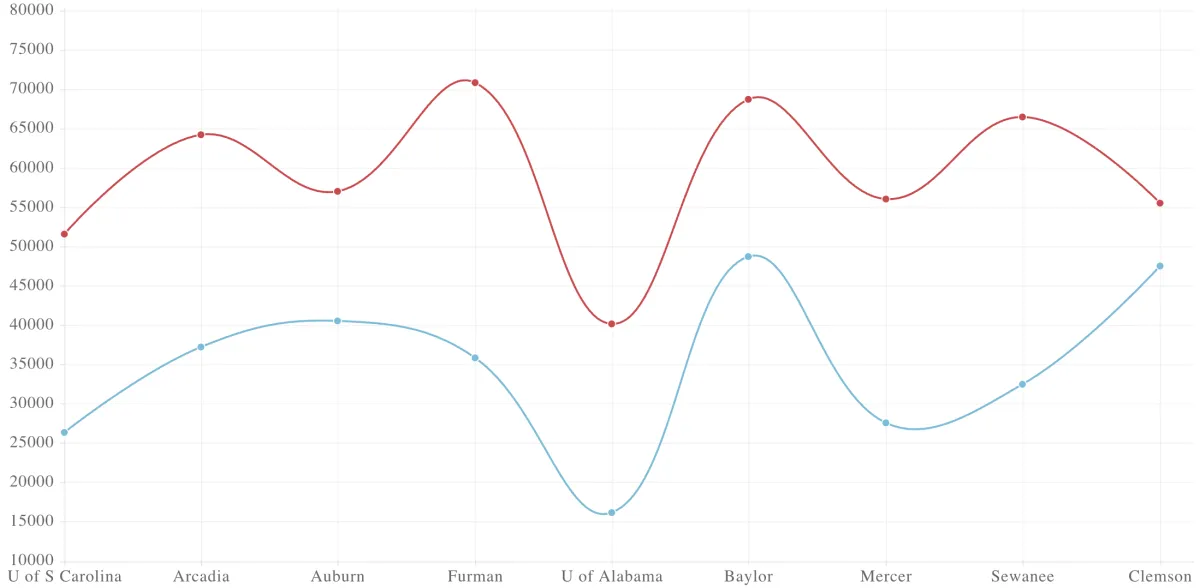

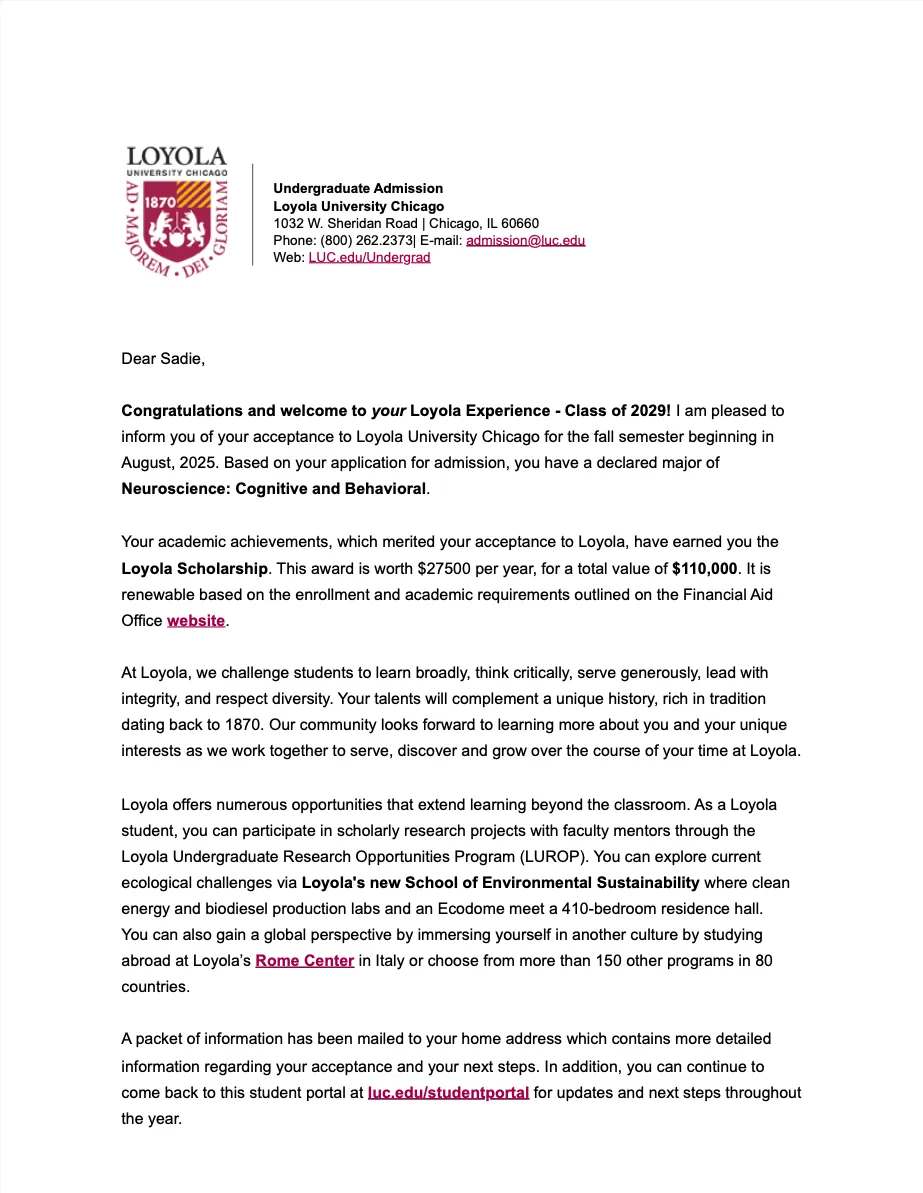

Award Analysis - Anna Holland

University of S. Carolina: Retail $51,583 | Wholesale $26,358

Arcadia University: Retail $64,220 | Wholesale $37,220

Auburn University: Retail $57,020 | Wholesale $40,540

Furman University: Retail $70,846 | Wholesale $35,846

University of Alabama: Retail $40,160 | Wholesale $16,160

Baylor University: Retail $68,722 | Wholesale $48,722

Mercer University: Retail $56,042 | Wholesale $27,576

Sewanee University of the South: Retail $66,480 | Wholesale $43,480

*2021 Award letter data provided by the Holland Family. Cost includes tuition, room and board, books, mandatory fees and personal expenses.

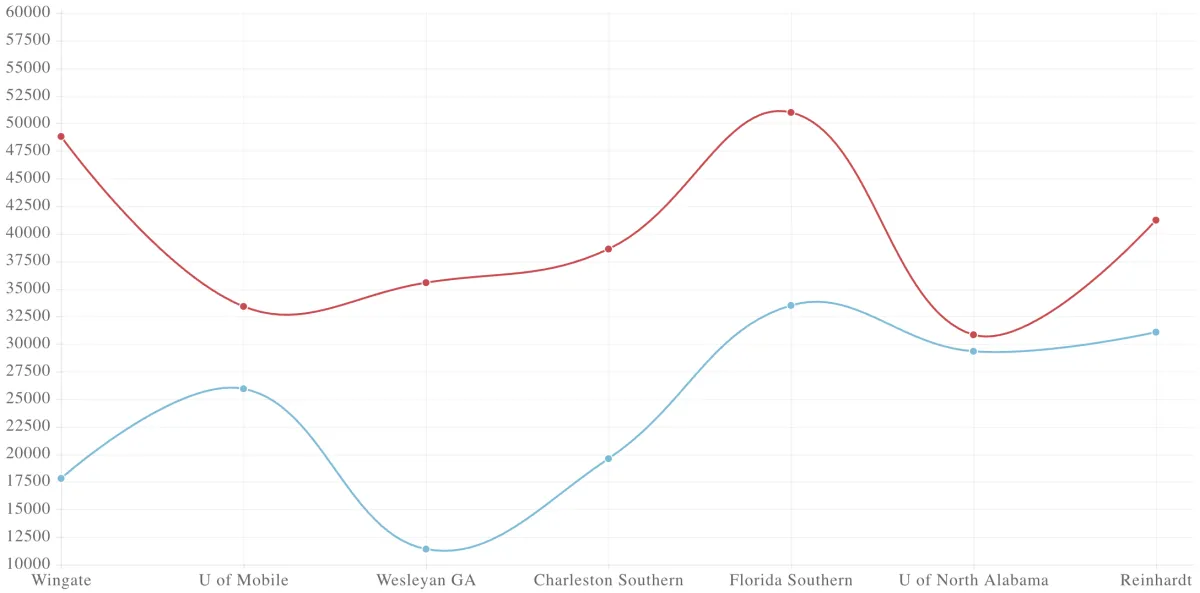

Awards Analysis - Sheridan Lillie

Wingate University: Retail $48,806 | Wholesale $17,806

University of Mobile: Retail $33,396 | Wholesale $25,936

Wesleyan GA: Retail $35,555 | Wholesale $11,401

Charleston Southern University: Retail $38,600 | Wholesale $19,600

Florida Southern University: Retail $50,986 | Wholesale $33,486

University of South Carolina: Retail $51,583 | Wholesale $26,358

University of North Alabama: Retail $30,828 | Wholesale $29,328

Reinhardt University: Retail $41,220 | Wholesale $31,066

*2021 Award letter data provided by the Holland Family. Cost includes tuition, room and board, books, mandatory fees and personal expenses.

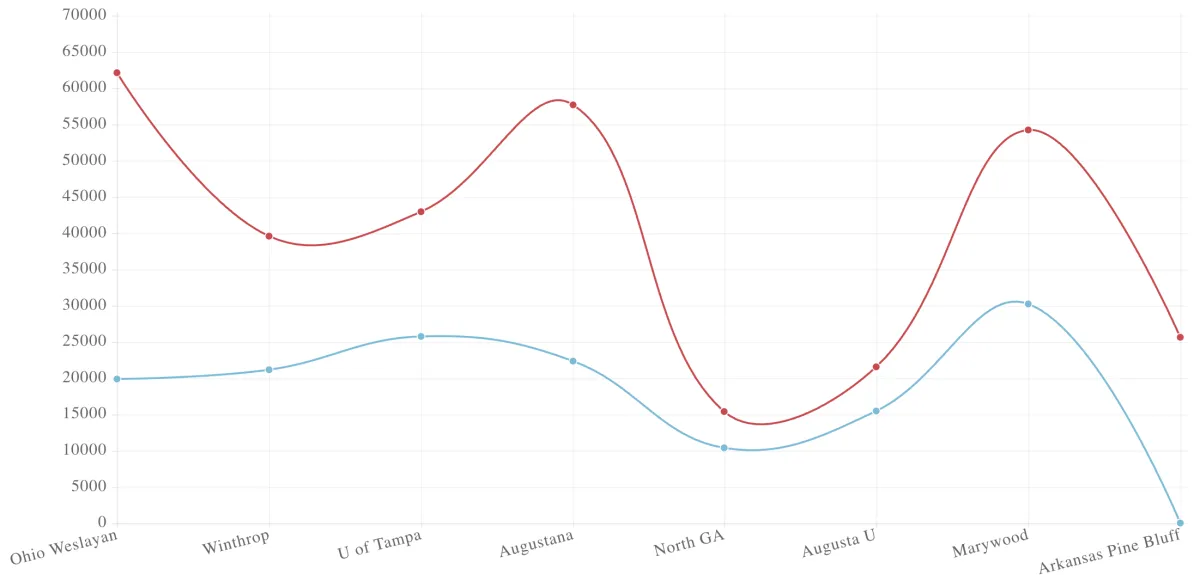

Awards Analysis - Christopher Ivory

Ohio Wesleyan University: Retail $62,120 | Wholesale $19,869

Winthrop University: Retail $39,576 | Wholesale $21,146

University of Tampa: Retail $42,944 | Wholesale $25,744

Augustana University: Retail $57,685 | Wholesale $22,335

North GA University: Retail $15,379 | Wholesale $10,369

Augusta University: Retail $21,544 | Wholesale $15,454

Marywood University: Retail $54,219 | Wholesale $30,219

U of Arkansas Pine Bluff: Retail $25,627 | Wholesale $0

*2021 Award letter data provided by the Holland Family. Cost includes tuition, room and board, books, mandatory fees and personal expenses.

Here’s what is going to happen when you work with us:

You can afford colleges you never thought possible.

You will know exactly where the money will come from.

You will no longer be bothered by all the noise.

You will see college costs get cut in half or more.

You can forget about the guilt of not having a college plan.

You can finally tear down all of the college myths.

You will stop wondering if you missed any steps.

You will stop guessing what you are supposed to do next.

You will stop guessing if your student will get into a college.

You will stop wondering if your student will get a scholarship.

You will sleep better at night.

Know your Student Aid Index (SAI) using our FAFSA Analysis & Strategy

This is the first step in knowing your SAI. What is your SAI? Can you get it lower?

Before, most families just applied for scholarships and financial aid just to see what happened. Sometimes we got a scholarship. Often times we did not.

Here, we take a proactive approach with a FAFSA Analysis.

Our simple analysis compiles all of your financial information and provides a profile based on all the financial aid methodologies the colleges use. With this information you know how much aid your family should get and which colleges will pay.

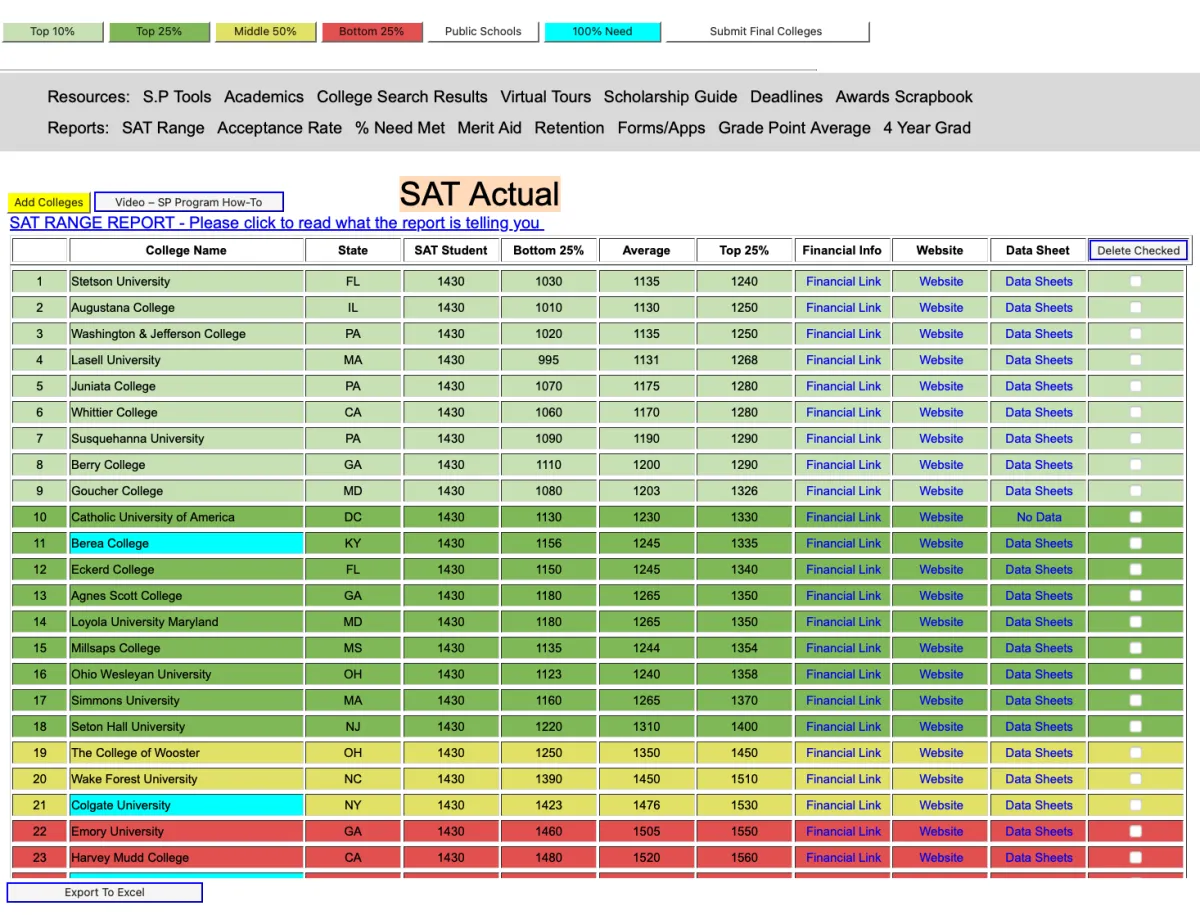

Build your college search on a solid foundation of empirical data using our Student Positioning System

Before, when you wanted to evaluate a college you would have to use some combination of college websites, Google search, magazine rankings and books with mixed results.

Or you can use our simple student positioning program to properly evaluate college metrics without the fragmented and typical time consuming approach of pulling from multiple or outdated sources. All the information you need in-house with our proprietary solution.

We have key metrics compiled for all of the colleges in the United States. Which colleges will your student be admitted to? Which colleges will pay? You will have all of these answers before you even apply.

Leave no money on the table with our Award Letter Analysis and Appeal Strategy

When you get an award letter, how will you know if it’s a good one? We compile, archive, and review all award letters and assign them a rating.

If we see an opportunity to get more aid, you will be the first to know. No more guessing.

Sleep better at night knowing where the money will come from with our Plan to Pay.

We all know what happens when families procrastinate. They wake up one day paying thousands of dollars a month in student loan payments.

Our families undergo a comprehensive financial review and we create plans that work. We lead families down a path where their students graduate without excessive student loan debt.

We build straightforward plans to pay with a mind for maximizing financial aid.

Increase your admissions chances and merit awards with our Social Media Courseware & Strategy

Instead of leaving their social media to chance, our solution gives our students the proper education and foundation needed to build a professional social media presence.

Our students leverage social media as a tool in the college and career search process. In addition, our students tell their unique story in a way that is discoverable and meaningful to the colleges.

The skills taught here will not only assist in the college admissions process but will also aid your student in the career search that follows after college.

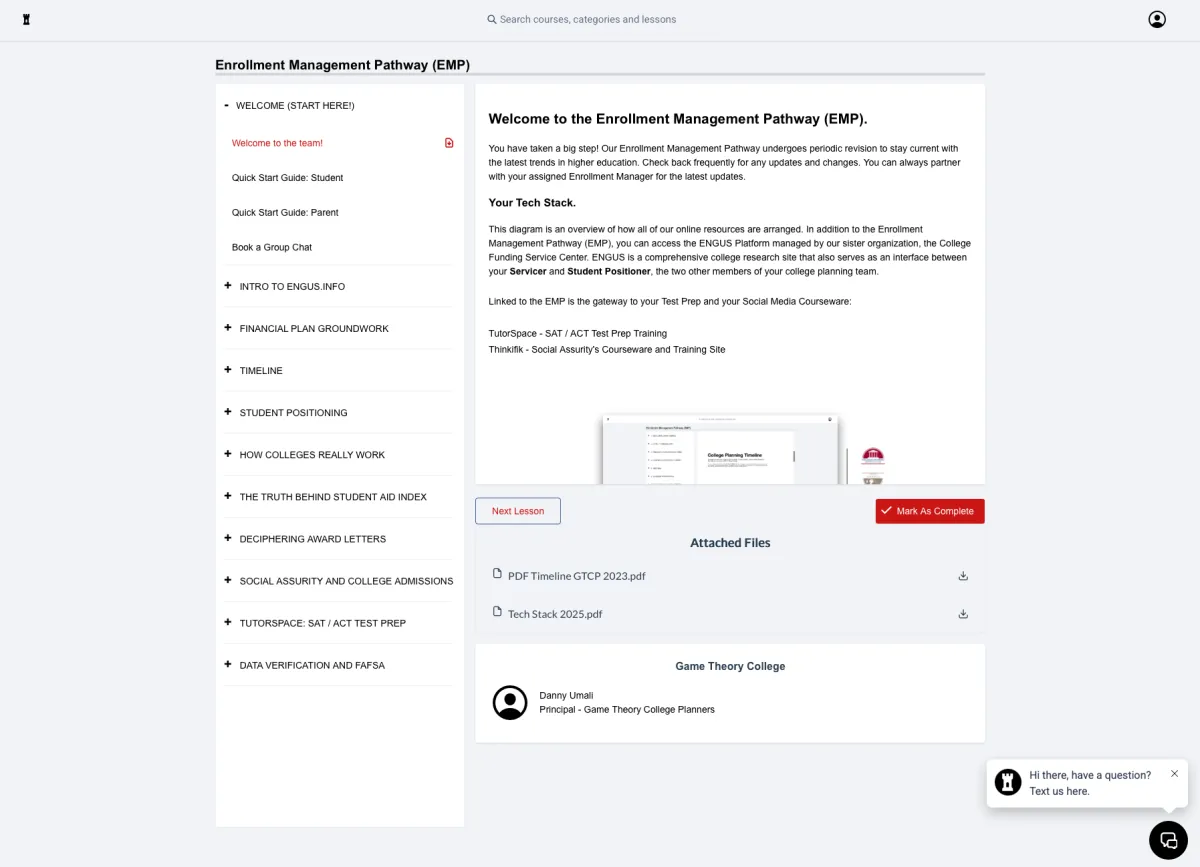

Stay on point and organized with our Enrollment Management Pathway.

How do all of these pieces fit together? Before, students and families just winged it. Deadlines came and went and applications were turned in late along with financial aid forms. Students would frequently “miss the boat.”

Our timeline keeps families on track with a simple task-based timeline adapted to your student’s grade level. You will never wonder about missed deadlines. You will never have to guess what happens next.

Bottom Line.

If you made it this far, you have probably received more education and insights at zero cost than you would probably get from most other admissions counselors or college planners in the game.

Now if you wanted to get this job done by some other admissions counselor or college planner, you would simply not get the same result. It would probably cost you thousands of dollars, not to mention the thousands extra you will end up paying for college.

Typical admissions counselors and college planners charge $6000 - $40,000; sometimes more. Other planners may charge a lower fee but nickel and dime you to with a monthly subscription charge, kicking you up to a higher total cost.

Like we said, we currently charge a fraction of what the other “college planners” charge despite the fact that we do more, a lot more.

With a dedicated enrollment manager, here is everything you will get:

FAFSA Analysis and Strategy: Valued at $1500

Social Media Courseware and Strategy: Valued at $500

Access to our Student Positioning System and college search engine: Valued at $1500

Award letter Analysis and Appeal Strategy: $1000

Enrollment Management Workflow and Timeline: $750

Plan to Pay: Valued at $1000

FASFA Prep Valued at $0 (per Dept of Ed Guidelines)

CSS Profile Form Prep: Valued at $500

Institutional Aid Form Prep: Valued at $500

1-Year subscription to Industry Leading online Test Prep: Valued at $400

Dedicated Career coach and Counselor: Valued at $750

Our service is valued at $9,000. Even at that price, we represent a tremendous value compared to other alternatives in the industry.

But for a limited time only, we are going to give you our service at a fraction of the cost.

We can only offer this special price for a limited time until we scale our operation to meet the relentless and insane demand for our service.

We can only bring on 70 new families a month. Make sure you grab your spot because getting on our calendar becomes increasingly difficult the closer we get to the end of the school year.

We only have the bandwidth to do 100 Discovery Sessions a month. Act now or you might not get a chance until next month. We are not joking. We are really that busy.

So let’s summarize this offer. With your dedicated enrollment manager, you get all of this valued at $9000.

FAFSA Analysis and Strategy: Valued at $1500

Social Media Courseware and Strategy: Valued at $500

Access to our Student Positioning System and college search engine: Valued at $1500

Award letter Analysis and Appeal Strategy: $1000

Enrollment Management Workflow and Timeline: $750

Plan to Pay: Valued at $1000

FASFA Prep Valued at $0 (per Dept of Ed Guidelines)

CSS Profile Form Prep: Valued at $500

Institutional Aid Form Prep: Valued at $500

1-Year subscription to Industry Leading online Test Prep: Valued at $400

Dedicated Career coach and Counselor: Valued at $750

Again, this offer represents a total value of $9,000. We would like to offer this at a fraction of the cost with an incredible discount.

This will be at a cost that is less than the fee that other college planners and admissions counselors already charge. We also deliver a service that is light years ahead of what other college planners and admissions counselors offer.

Schedule your free Enrollment Pathway Session to see if this process can make a dramatic and positive impact to the way you plan and pay for college. You can't buy anything during this session. This session is informational only. Click the link below to schedule your session.

We'll see you on the other side!

©2026 Game Theory College Planners, Inc. All rights reserved. Privacy Policy | Terms of use | We are a national service provider based in Atlanta, GA.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok