6. Creating competition between colleges maximizes merit aid.

Old Way

We enter the college marketplace ready to buy a college thinking the colleges set the price as the sellers. We are unaware of the price “elasticity” that exists with colleges.

Old Result

We end up overpaying for college since we do not truly understand the dynamic relationship of who the buyers and sellers really are.

New Way

We evaluate colleges by their enrollment yield. We use additional metrics to filter out colleges that are willing to buy your student vs. colleges that are not. We understand that the colleges are the buyers looking to buy my students with thousands of dollars in merit aid. We understand that competition drives the merit award process. We get our students into some of the best colleges in the country at a fraction of the price because we are not beholden to outdated thinking.

New Result

Through competition we have maximized our merit awards while gaining more options to attend a great college at a significantly lower cost.

We teach families a shift in perspective very few people get to see: Colleges are buying students instead of the other way around. Though we have been teaching this for over a decade, it’s great to see this insight finally shared in the mainstream.

To discover whether a college is a buyer or seller, look at the percentage of applicants it admits, the percentage of those who choose to enroll (the yield rate), and the percentage of institutional aid that is given out without respect to an applicant’s financial need. The lower the admit rate, the higher the yield, and the larger the percentage of aid based on need, the more likely the school is a seller.

You can find this information on a school’s Common Data Set questionnaire (found via an internet search) or simply ask them. Savvy students willing to look beyond the brand-name sellers can find great schools that are buyers. Compare, for example, two private, urban universities in the south. Emory University in Atlanta, with a sticker price around $70,000 a year, accepts less than one-fifth of applicants and spends less than 10% of its financial aid on merit-based discounts.

Emory is a seller. New Orleans-based Tulane University, with a nearly identical sticker price, spends more than half of its institutional aid budget on merit-based aid. Yet both schools attract top-tier students with average SAT scores near 1500.”

- Opinion: How to use a Moneyball strategy for college applications and find excellent schools that are undervalued Nov. 27, 2020 . By Jeffrey Selingo

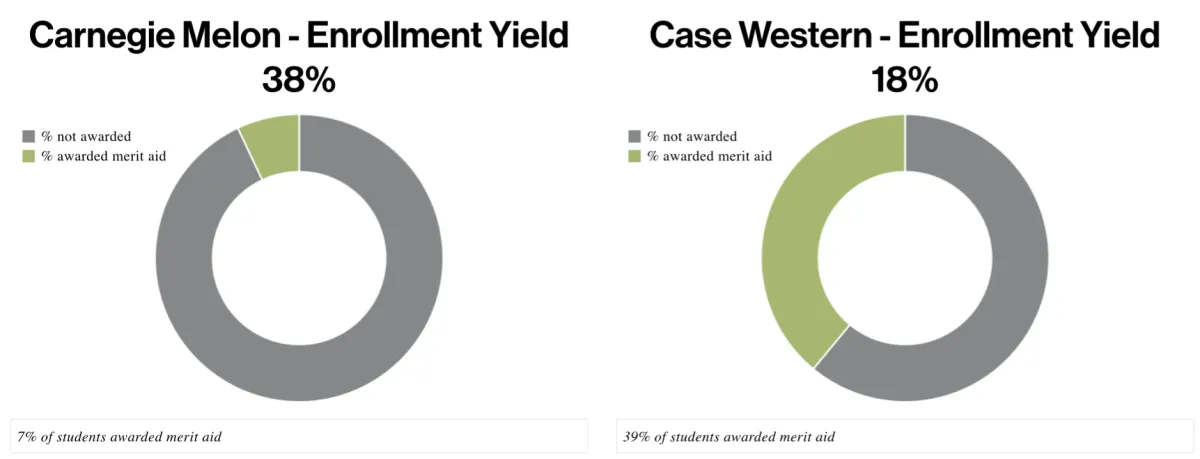

When you look at the patterns, lower enrollment yields suggest a college that “buys.” These colleges tend to be more flexible with pricing and are more susceptible to competition with other colleges by maximizing merit scholarships to fill their seats.

(Enrollment yield is the percentage of accepted students that actually enroll).

A common trend in Higher Ed: Lower enrollment yield tends to indicate more merit aid awarded, or a college that “buys” and competes for their students.

Here’s what you really need to know: Competition is a byproduct of our collective strategies.

By going after colleges that are ultra-personalized to your student from academic fit and aligning them to your financial aid profile (throw in some additional engagement from social media), not only are we compiling a list of great prospective colleges, we are creating a list of colleges that naturally compete with one another.

Source: Jeff Selingo analysis of U.S Department of Education’s IPEDS surveys (2028-2019); Common Data Set (2028-2019)

Check out this NPR Planet Money podcast. We came across this podcast back in 2012 that spilled the beans about how colleges really buy students.

Families think that their sons and daughters are awarded a merit scholarship because of the fact that they are wonderfully smart and talented and in fact, that's part of it. But the bottom line is the primary reason for awarding a non-need based merit scholarship is to change a student's enrollment decision from another institution to our institution. That's why colleges do it."

Bob Masa - NPR Planet Money Podcast: How Colleges Fight For Top Students

FAQ

Is it only low ranked schools that are desperate enough to buy students?

Not at all. If you look at the examples of the enrollment yields presented above, we don’t think anyone with any credibility would suggest that these colleges are in any way “second rate.”

What kind of test scores and GPA does my student need for a college to compete in this way?

There are a lot of variables in addition to test score and GPA. We’ve seen these results for students with GPAs as low as 2.4 and with test scores as low as an 800 on the SAT.

Does this mean that colleges will negotiate their pricing?

It can. However, colleges do not call this a negotiation. This is referred to as professional judgement or a financial aid appeal. We don’t recommend running into the financial aid office with competing award letters in your hand demanding more cash. There’s a process and an art to this that usually boils down to one of three versions:

1. You ask for more aid and see what you get. 2. You ask for more aid but you give them a number you have in mind. 3. You do some combination of no. 1 & 2 and you show them a competing award letter.

Keep in mind that some colleges do not appeal financial aid outside of unusual and unique circumstances, but many colleges will consider a competing offer.

©2026 Game Theory College Planners, Inc. All rights reserved. Privacy Policy | Terms of use | We are a national service provider based in Atlanta, GA.